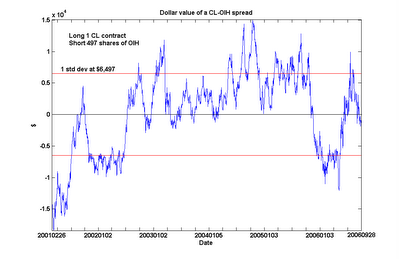

The plot is of the dollar value of long 1 contract of Cl and short 497 shares of OIH. They do cointegrate with over 90% probability. (I also plotted the 1 standard deviation lines of the spread to facilitate those who want to look for approximate entry points.) The cointegration probability is not measurably better than that between CL and XLE. However, the current spread (as of the close of Nov 20) is undervalued by only $9,617 (or 1.48 standard deviation), as opposed to $10,508 (or 1.74 standard deviation) for the CL-XLE spread. (I determined the standard deviation of the CL-XLE spread to be about $6,040). So in recent months, one can indeed say that OIH is trading more in line with spot oil price than XLE. But as an arbitrageur who thinks the larger the spread, the bigger the profit opportunity, this is not an endorsement for buying the CL-OIH spread instead. Rather, I would consider adding this spread as a means of diversification.

Thanks, Yaser and Jim, for this suggestion!

No comments:

Post a Comment